Two of the principal teachings of Toyota-style kaizen is to think of cost problems in terms of processes and in non-financial terms such as time, distance, space, defects, quantity, turnbacks, etc. To be able to effectively think in non-financial terms, we were taught to understand the difference between value-added work, waste, unevenness, and unreasonableness. These two learnings made a big impact on me because thinking in this way led to improvements that could not otherwise be achieved by thinking about cost problems in terms of money or budgets (both of which I was well-versed in, having been responsible for P&L as a project manager and as a business unit manager).

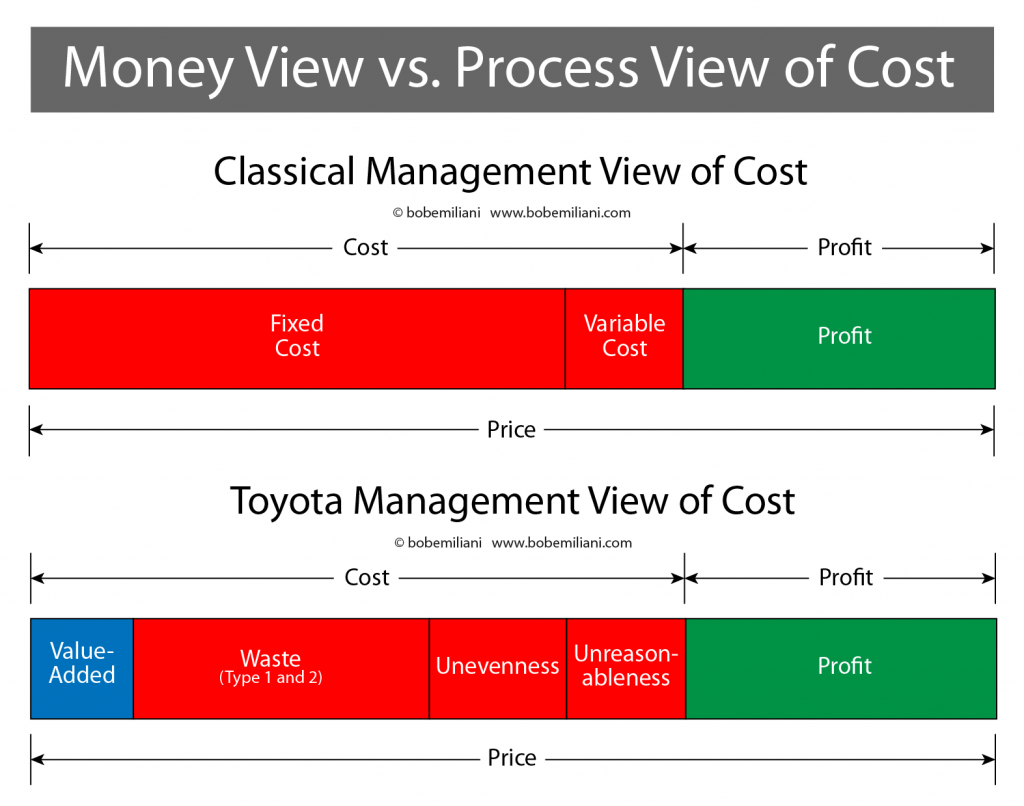

The money view of cost problems is a frame that leads to a narrow choice of possible solutions. In contrast, the process view of cost problems is a frame that leads to a wide range of possible solutions. The image at right shows the two frames — the two views of cost — based on money (Classical management, top) and process (Toyota management, bottom).

The Classical management view of cost shows a major defect in the understanding of costs (fixed cost/variable cost) that spans economics, finance, investment banking, private equity, accounting, and, of course, management decision-making, and which, in turn, has far-reaching consequences. Namely, it sabotages Lean, and is one of the many controlling mechanisms used by leaders to reject Lean, knowingly or otherwise. In economics, accounting, etc., costs exist abstractly outside the reality of physical processes as fixed costs and variable costs, and so management’s response to cost problems is different (de jure) than the response to cost problems understood in physical reality (de facto).

The Toyota management view of cost shows how the defect was repaired: via the realization that processes generate costs. If you improve the process — with an understanding of value-added work, waste, unevenness, and unreasonableness — then the cost is reduced (inclusive of improvement in all the non-financial parameters cited above). The result, if kaizen is practiced consistently, is the development of human capabilities, improved management decision-making, and production of consistent business results.

CEOs and CFOs think in terms of abstract fixed costs and variable costs (and spreadsheets, also abstract, as is money itself) while workers think in terms of physical processes. Leaders cannot understand costs if they do not understand physical processes, and so the quality of their decision-making will be greatly reduced and always cluster around the same set of solutions that every other CEO and CFO uses. There is no creativity or originality in problem-solving when cost problems in business exist as abstractions. And that is why business always moves confidently in the direction of that which has been previously established. In other words, status quo.

Executives’ unwillingness to learn the physical reality of processes and costs is a conscious withdrawal of discovery, learning, and enlightenment. It is purposeful underemployment of executive capability, in preference for whim, and which in turn assures worker capability is likewise underemployed. In making this fateful decision, executives assure that the business will run with waste, unevenness, and unreasonableness as features of management practice rather than as flaws in management practice. Upon deeper analysis, one finds that this is an integral part of the design of Classical management in market economies. The process view of cost is therefore unwelcome, which means Lean is unwelcome.

I say “fateful decision” because it rejects process, and therefore sequential or consecutive change, and cause-and-effect. Business remains on a largely non-scientific and non-evolutionary footing in that when change does occur, it is but a small difference from the previous way of thinking and doing things — often a difference largely in name only. Management decision-making favors as hoc, whatever-is-right-for-the-moment decisions, and thus fails to build on the success and failures of self or others — as is the case in science or engineering, which are clearly evolutionary.

In business, the same mistakes are repeated again and again because management ignores process and causation. A classic example is when a subordinate is unable to tell the boss the truth when a problem arises, or when managers ignore the root cause of a problem because it is economically, socially, or politically inconvenient. Business, as represented by Classical management practice, remains static, rather than dynamic as is the case for Toyota management.

Business is classified as a social science, and business characteristics are likewise classified according to a taxonomy of static technical terms. Business lives up to the word “social,” but it fails to live up to the word “science.” To become an evolutionary science — one that benefits humanity to greater levels than it has thus far — and which will be necessary for the future — business leaders must accept both process (sequential or consecutive change) and causality.